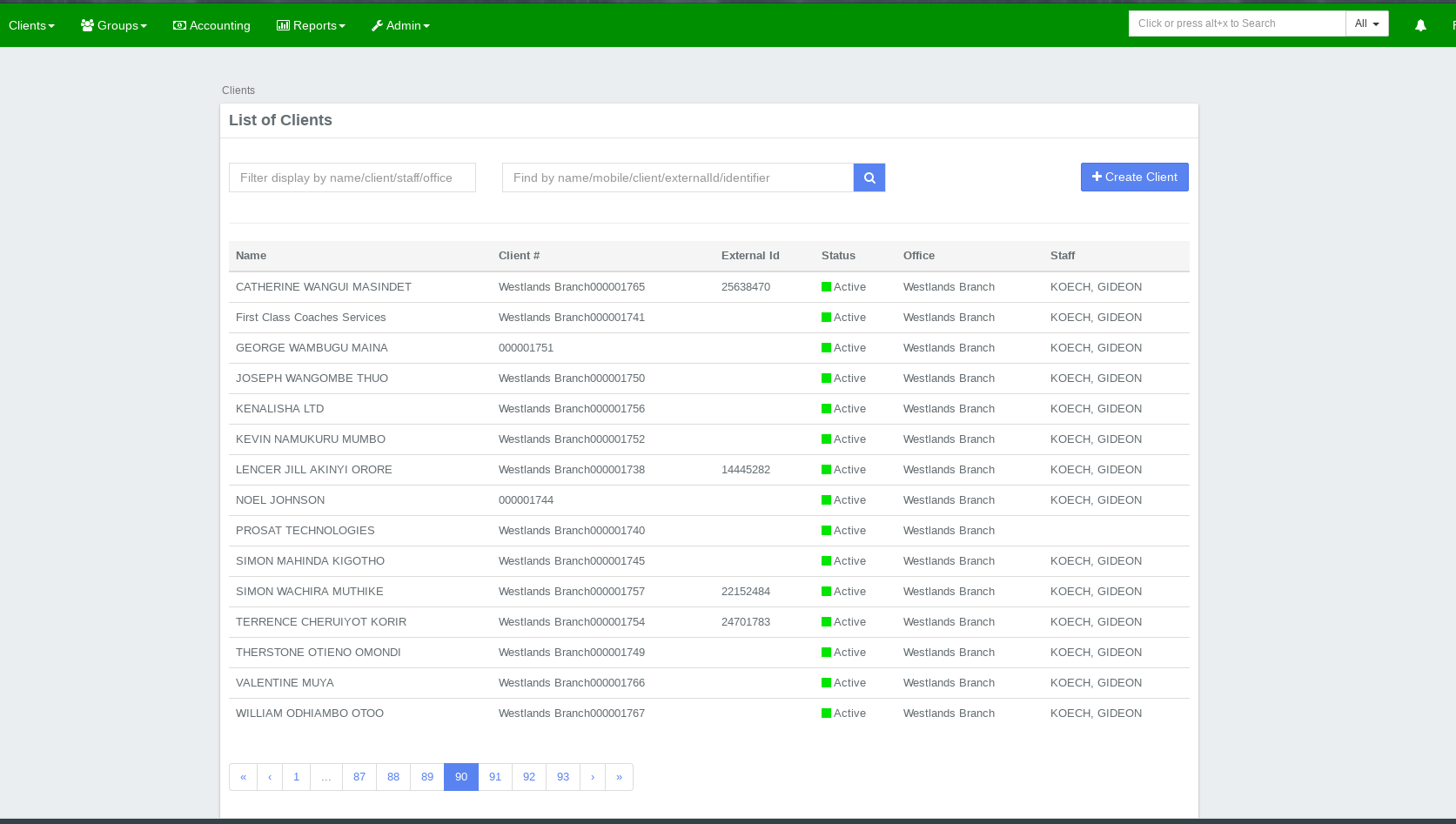

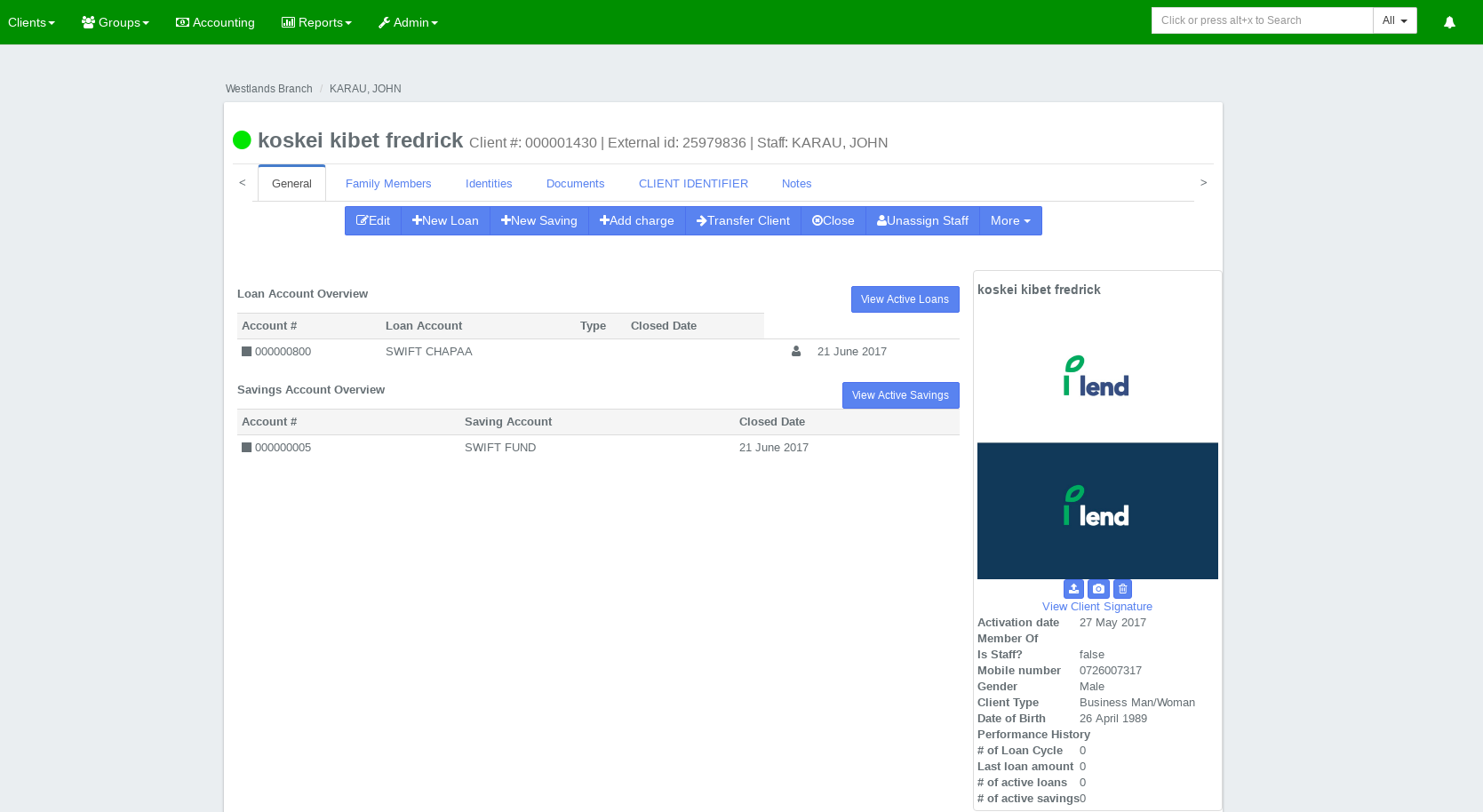

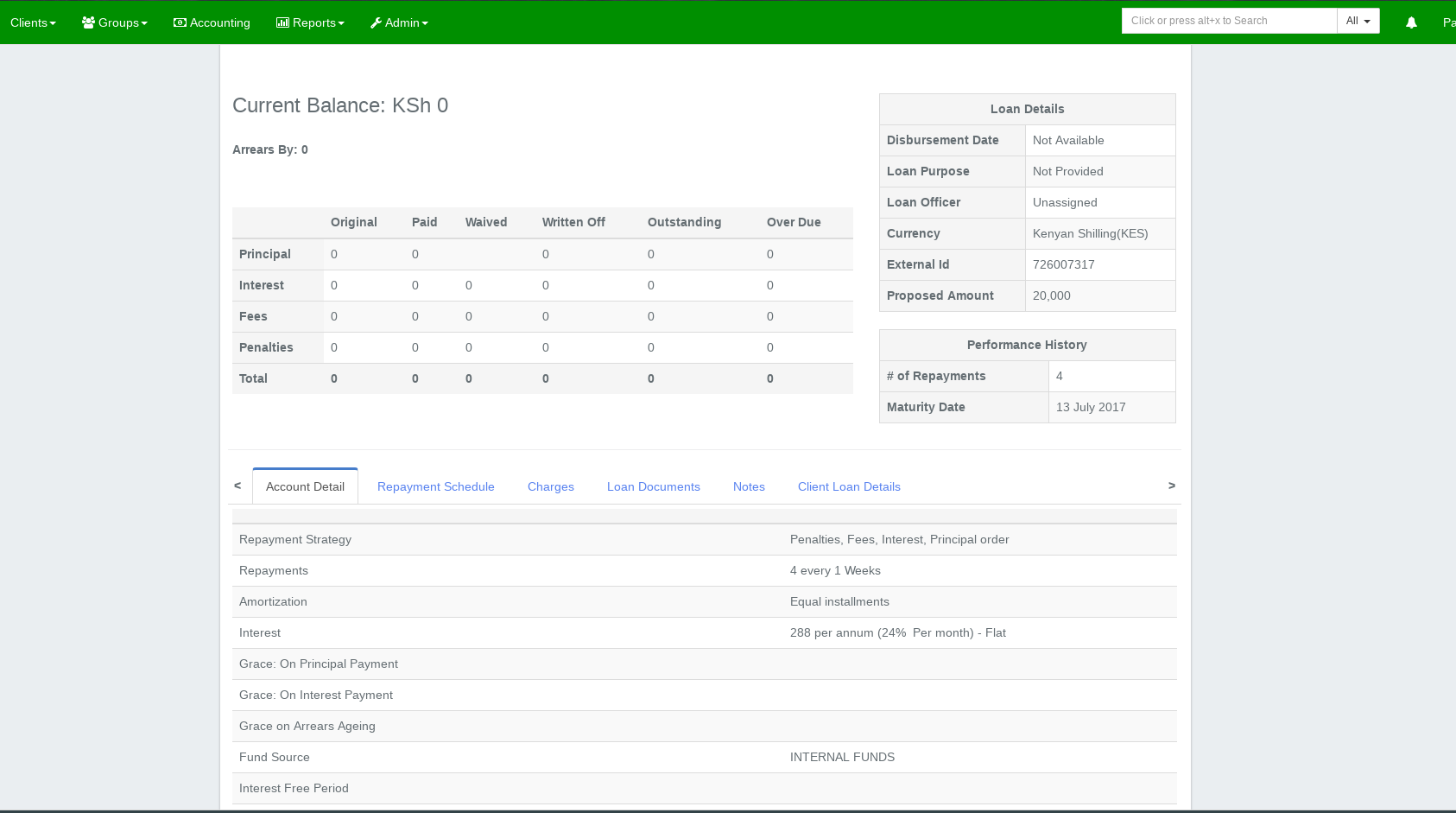

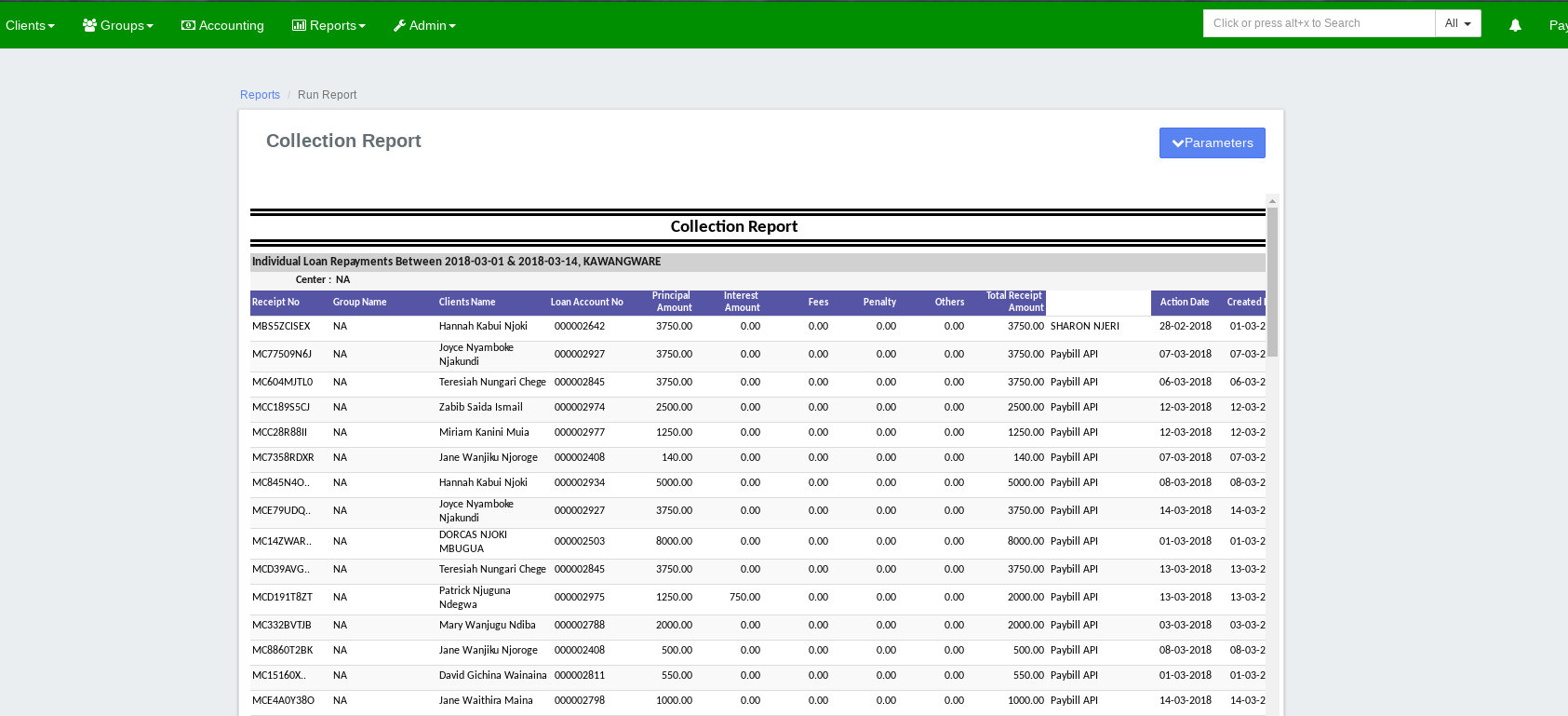

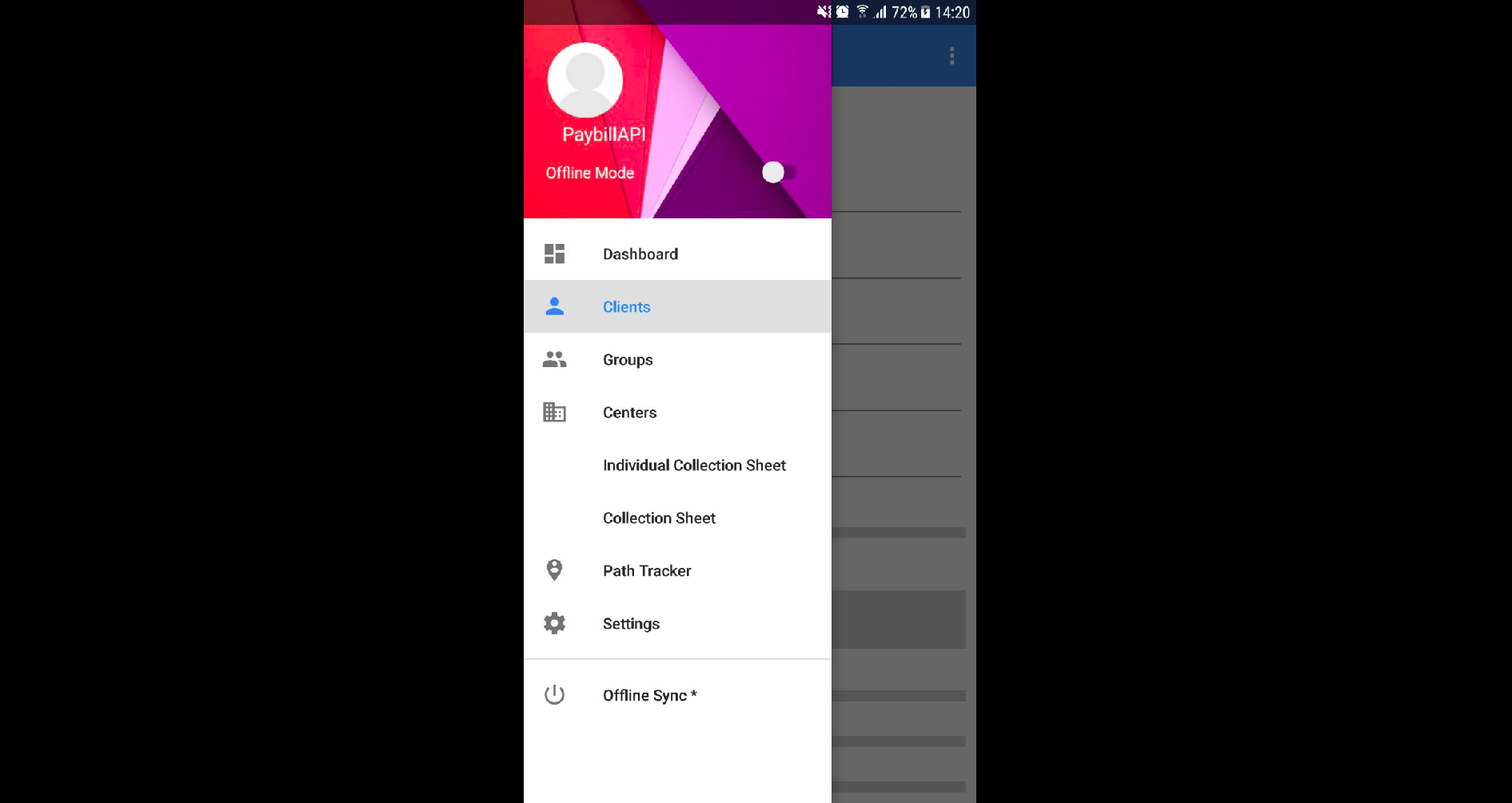

User-friendly

I-lend's System has a simple and clear user interface, with best-practice workflows taking you through all core processes, and relevant data always at your fingertips. The IFC recently described it as “so user friendly that loan officers are not required to be proficient in IT. The system has a simple graphic user interface and features a logical distribution of functions, so each user can easily access and manipulate the information they require.”